Break-even analysis also can help companies determine the level of sales (in dollars or in units) that is needed to make a desired profit. Examples of the Effects of Variable and Fixed Costs in Determining the Break-Even PointĬompanies typically do not want to simply break even, as they are in business to make a profit.

In order for us to verify that Hicks’ break-even point is $22,500 (or 225 units) we will look again at the contribution margin income statement at break-even: Figure 7.25 By: Rice University Source: Openstax CC BY-NC-SA 4.0īy knowing at what level sales are sufficient to cover fixed expenses is critical, but companies want to be able to make a profit and can use this break-even analysis to help them. Hicks Manufacturing will have to generate $22,500 in monthly sales in order to cover all of their fixed costs.

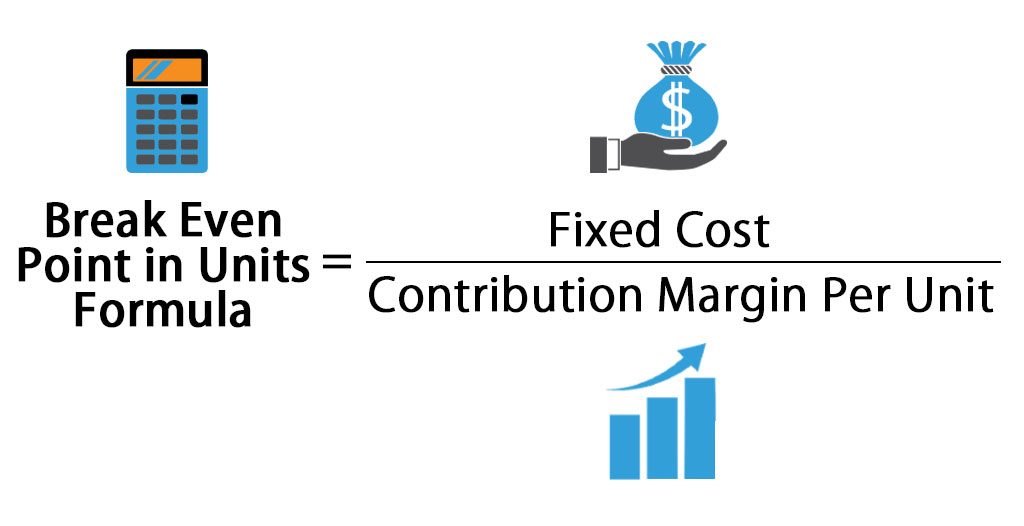

In order to find their break-even point, we will use the contribution margin for the Blue Jay and determine how many contribution margins we need in order to cover the fixed expenses, as shown in the formula in Figure 7.17. Information on this product is: By: Rice University Source: Openstax CC BY-NC-SA 4.0 In other words, the managers at Hicks want to know how many Blue Jay birdbaths they will need to sell in order to cover their fixed expenses and break even. The operating income is determined by subtracting the total variable and fixed costs from the sales revenue generated by an enterprise. They will break even when the operating income is $0. Hicks Manufacturing is interested in finding out the point at which they break even selling their Blue Jay Model birdbath. To illustrate the concept of break-even, we will return to Hicks Manufacturing and look at the Blue Jay birdbath they manufacture and sell. Eventually the company will suffer losses so great that they are forced to close their doors. No business can operate for very long below break-even. Since the break-even point represents that point where the company is neither losing nor making money, managers need to make decisions that will help the company reach and exceed this point as quickly as possible. Larger companies may look at the break-even point when investing in new machinery, plants, or equipment in order to predict how long it will take for their sales volume to cover new or additional fixed costs. When a company first starts out, it is important for the owners to know when their sales will be sufficient to cover all of their fixed costs and begin to generate a profit for the business. Because of its universal applicability, it is a critical concept to managers, business owners, and accountants. While there are exceptions and complications that could be incorporated, these are the general guidelines for break-even analysis.Īs you can imagine, the concept of the break-even point applies to every business endeavor-manufacturing, retail, and service. After the next sale beyond the break-even point, the company will begin to make a profit, and the profit will continue to increase as more units are sold. At this stage, the company is theoretically realizing neither a profit nor a loss. Once we reach the break-even point for each unit sold the company will realize an increase in profits of $150.įor each additional unit sold, the loss typically is lessened until it reaches the break-even point. This relationship will be continued until we reach the break-even point, where total revenue equals total costs. If it subsequently sells units, the loss would be reduced by $150 (the contribution margin) for each unit sold. This loss explains why the company’s cost graph recognized costs (in this example, $20,000) even though there were no sales. It would realize a loss of $20,000 (the fixed costs) since it recognized no revenue or variable costs.

For example, assume that in an extreme case the company has fixed costs of $20,000, a sales price of $400 per unit and variable costs of $250 per unit, and it sells no units. The basic theory illustrated in Figure 7.15 is that, because of the existence of fixed costs in most production processes, in the first stages of production and subsequent sale of the products, the company will realize a loss. Figure 7.15 Break-Even Point By: Rice University Source: Openstax CC BY-NC-SA 4.0 Long Description

0 kommentar(er)

0 kommentar(er)